This report is usually published in January. This year, it was published in April to give the Congressional Budget Office time to analyze and incorporate some of the effects of recent major legislation, particularly Public Law 115-97 (originally called the Tax Cuts and Jobs Act and called the 2017 tax act in this report), which was enacted on December 22, 2017; the Bipartisan Budget Act of 2018 (P.L. 115-123), which was enacted on February 9, 2018; and the Consolidated Appropriations Act, 2018 (P.L. 115-141), which was enacted on March 23, 2018. Unless the report notes otherwise, the projections in it do not reflect economic developments, administrative actions, or regulatory changes that occurred after mid-February 2018.

Members of Congress, media watchers and reporters, activists of federal operations and financial matters, economists, economic forecasters, business financial officers, business marketers.

Summary 1

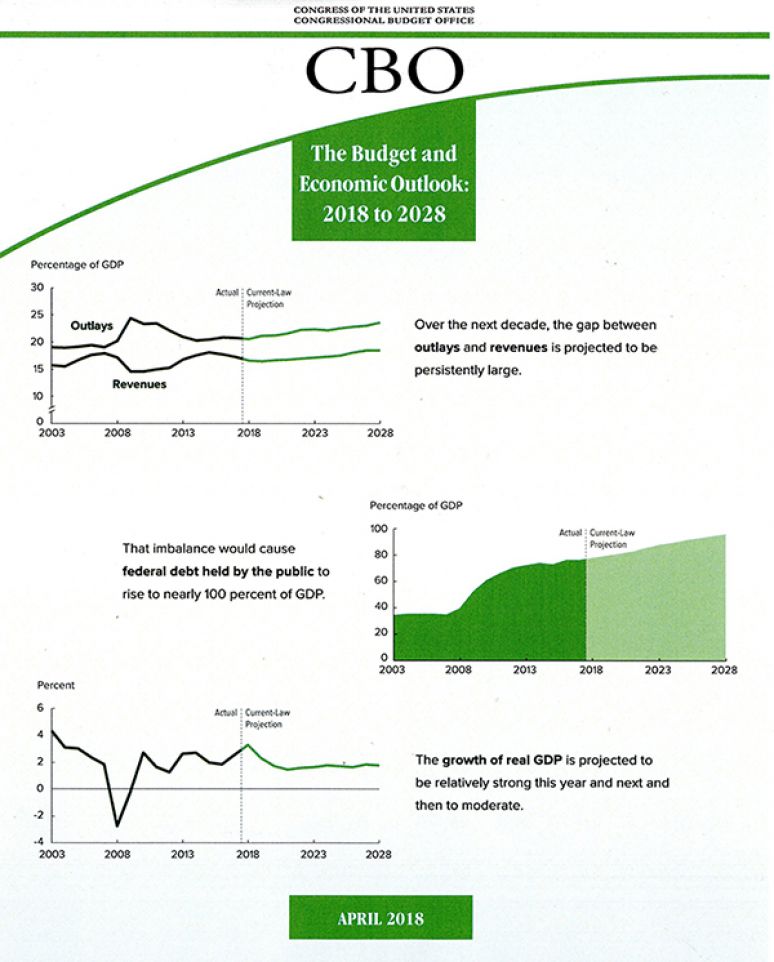

Economic Growth Is Projected to Be Relatively Strong This Year and Next and

Then to Moderate 1

GDP Is Projected to Be Greater Than CBO Previously Estimated 3

Deficits Are Projected to Be Large by Historical Standards 3

Deficits Are Projected to Be Larger Than CBO Previously Estimated 5

Debt Held by the Public Is Projected to Approach 100 Percent of GDP 5

Deficits and Debt Would Be Larger If Some Current Policies Were Continued 6

The Economic Outlook 7

Overview 7

Recent Economic Developments 11

The Economic Effects of Recent Changes in Fiscal Policy 11

Potential Output 14

Actual Output 17

The Labor Market 26

Inflation 28

Monetary Policy and Interest Rates 29

Income 29

Uncertainty Surrounding the Economic Outlook 32

Comparisons With CBO’s June 2017 Projections 33

Comparisons With Other Economic Projections 39

The Spending Outlook 43

Overview 43

Mandatory Spending 45

BOX 2-1. CATEGORIES OF FEDERAL SPENDING 46

Discretionary Spending 54

Net Interest 61

Uncertainty Surrounding the Spending Outlook 62

The Revenue Outlook 63

Overview 63

The Evolving Composition of Revenues 64

Individual Income Taxes 65

Payroll Taxes 68

Corporate Income Taxes 69

Smaller Sources of Revenues 71

Tax Expenditures 74

Uncertainty Surrounding the Revenue Outlook 78

3

II The Budget and Economic Outlook: 2018 to 2028 April 2018

A Changes in CBO’s Baseline Projections Since June 2017 93

B The Effects of the 2017 Tax Act on CBO’s Economic and Budget Projections 105

C Trust Funds 131

D CBO’s Economic Projections for 2018 to 2028 139

E Historical Budget Data 143

The Outlook for Deficits and Debt 79

Overview 79

Deficits 79

Debt 85

Alternative Assumptions About Fiscal Policy 88

Changes in CBO’s Baseline Projections Since June 2017 93

Overview 93

Legislative Changes 93

Economic Changes 99

Technical Changes 101

The Effects of the 2017 Tax Act on CBO’s Economic and Budget Projections 105

Overview 105

The Major Provisions of the Act 106

BOX B-1. REPATRIATION OF UNDISTRIBUTED FOREIGN EARNINGS 109

How the Act Affects the Economic Outlook 114

BOX B-2. COMPARISON WITH OTHER ORGANIZATIONS’ ESTIMATES 117

BOX B-3. THE EFFECTS OF PROFIT SHIFTING ON ECONOMIC STATISTICS 124

How the Act Affects the Budget Outlook 128

Uncertainty Surrounding CBO’s Estimates 129

Trust Funds 131

Overview 131

Social Security’s Trust Funds 134

Trust Funds for Federal Employees’ Retirement Programs 134

Medicare’s Trust Funds 136

Highway Trust Fund 137

CBO’s Economic Projections for 2018 to 2028 139

Historical Budget Data 143

List of Tables and Figures 155

About This Document

Product Details

- Budgets

- Federal Budgets