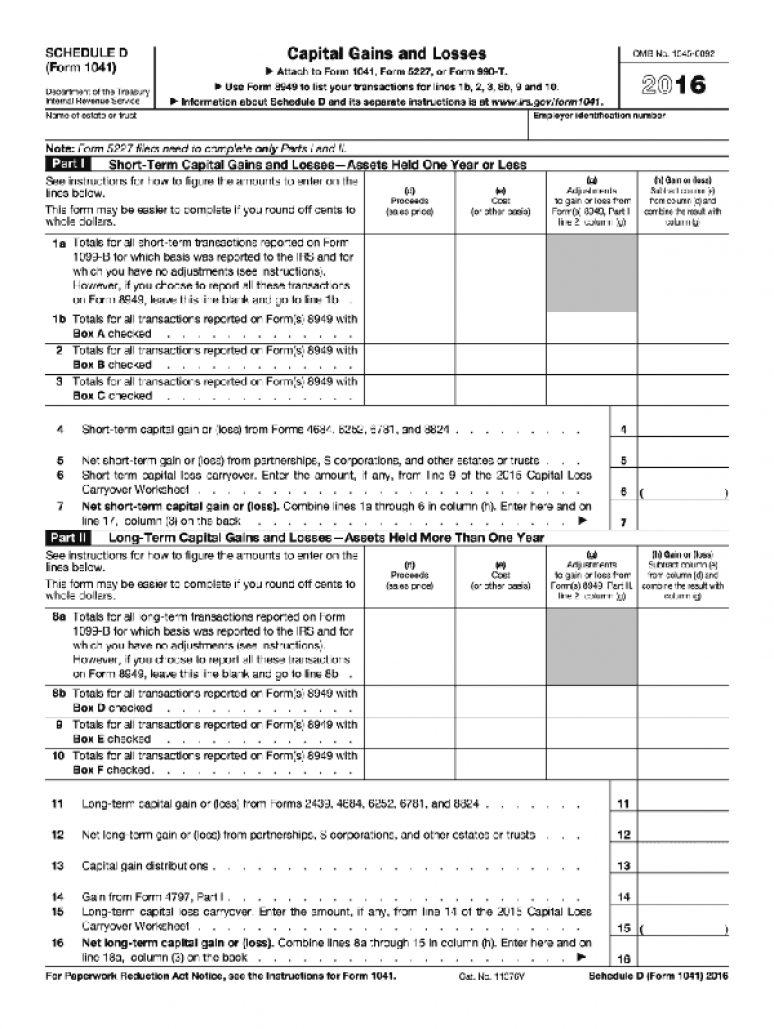

These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D:

-To figure the overall gain or loss from transactions reported on Form 8949;

-To report certain transactions you don't have to report on Form 8949;

-To report a gain from Form 2439 or 6252 or Part I of Form 4797;

-To report a gain or loss from Form 4684, 6781, or 8824;

-To report a gain or loss from a partnership, S corporation, estate or trust;

-To report capital gain distributions not reported directly on Form 1040, line 13

(or effectively connected capital gain distributions not reported directly on Form

1040NR, line 14); and

-To report a capital loss carryover from 2015 to 2016.

U.S. taxpayers, accountants, CPAs, tax preparers

Product Details

- IRS Tax Form 1040, Schedule D 2016